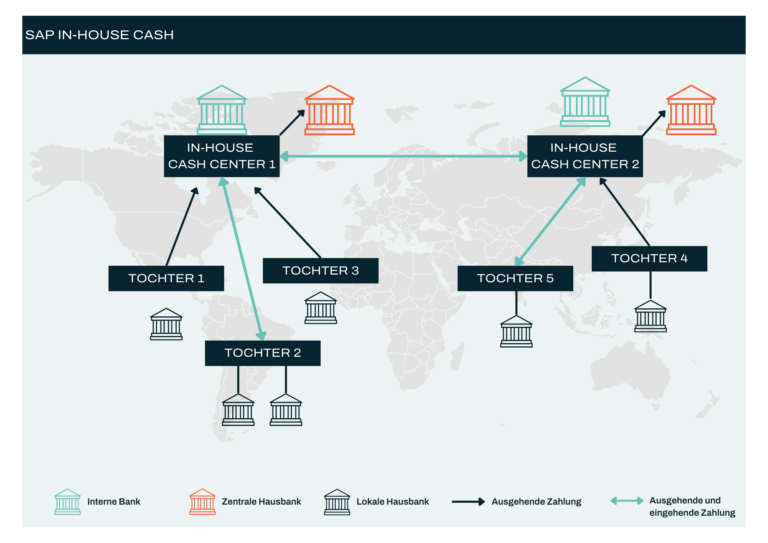

With SAP In-House Cash, you can implement a centralized banking solution in your corporate structure to efficiently and automatically process internal and external payment flows and significantly reduce your transaction costs. Bundling cash holdings in a target account, which is achieved through the netting process, also gives you a more transparent view of your liquidity.

Would you like to learn more about the special features and possibilities for your company? Our consultants are available for an initial consultation.

With the integration of SAP In-House Cash, your subsidiaries maintain in-house bank accounts with the parent company, which operates the in-house bank. The parent company’s in-house bank, as a strategic unit, can perform all the functions of external banking institutions and takes on core tasks such as balancing accounts and closing them via the general ledger account, automatically posting interest, and creating internal account statements.

If you operate group-wide cash pooling, the resulting IC receivables and payables are also processed automatically via the account statement.

Payment transactions outside the group between the companies participating in the IHC and their creditors or external bank accounts can also be handled and optimized using SAP In-House Cash (avoiding cross-border payments).

External payments made by a subsidiary are not processed by the central holding company, but are regulated by another subsidiary affiliated with the IHC. This concept is particularly important for groups with a high degree of internationalization or cross-currency payment transactions.

The central company regulates the liabilities of its subsidiaries via its external bank accounts. The number of local accounts can be reduced and the effort required for format reconciliation is significantly reduced.

Each company maintains a group-wide cash pool that pools liquidity in an external bank account held by the parent company. Based on the information in the account statement, the pooled amounts are adjusted, interest is calculated, and they are correctly accounted for in In-House Cash.

SAP In-House Cash enables a centralized banking solution to efficiently process internal and external payment flows and reduce transaction costs. With functions such as cash pooling and netting, it offers a transparent view of liquidity, simplifies group-wide payment processing, and avoids costly cross-border payments. In addition, subsidiaries can maintain in-house bank accounts with the parent company, minimizing external banking transactions.

SAP In-House Cash covers various payment processes:

This flexibility supports companies with international structures and complex financial requirements.

Long-term partnerships, customer satisfaction, and sustainable success are the benchmarks of our own success.